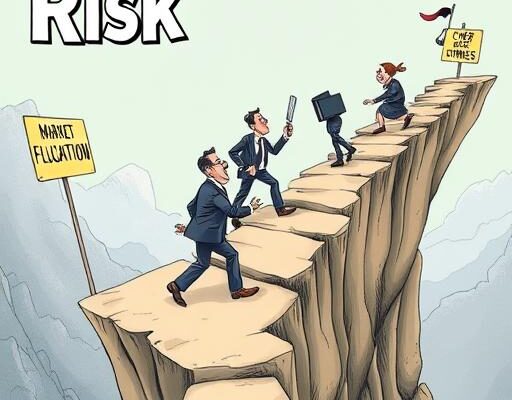

In the realm of business and personal finance, insurance serves as a powerful tool for mitigating risks and transferring potential liabilities to safeguard assets and ensure financial stability. Understanding the nuances of insurance strategies is crucial for individuals and organizations looking to protect themselves against unforeseen events and uncertainties. This comprehensive guide delves into the realm of insurance, exploring key strategies for risk mitigation and transfer to secure a resilient financial future.

Unpacking Insurance Strategies for Risk Management

Insurance strategies encompass a range of products and solutions designed to mitigate financial risks and provide a safety net in the face of unexpected events. By leveraging insurance effectively, individuals and businesses can protect themselves from losses, liabilities, and disruptions that could jeopardize their financial well-being.

Key Insurance Strategies for Risk Mitigation and Transfer

- Risk Assessment and Coverage Analysis: Conducting a thorough risk assessment to identify potential threats and vulnerabilities is the first step in developing an effective insurance strategy. Analyzing existing coverage, gaps in protection, and specific insurance needs enables individuals and businesses to tailor their insurance portfolio to mitigate identified risks.

- Diversification of Insurance Products: Diversifying insurance coverage across different types of policies, such as property insurance, liability insurance, health insurance, and business interruption insurance, ensures comprehensive protection against a wide range of risks. A well-rounded insurance portfolio hedges against diverse threats and minimizes exposure to financial losses.

- Customized Insurance Solutions: Working with insurance professionals to customize insurance solutions based on individual needs, risk tolerance, and financial goals enhances the effectiveness of risk mitigation strategies. Tailored insurance products offer targeted coverage for specific risks and provide personalized protection that aligns with unique circumstances.

- Claims Management and Review: Establishing efficient claims management protocols, maintaining up-to-date records of insurance policies, and regularly reviewing coverage adequacy are essential practices for effective risk transfer. Timely claims processing, accurate documentation, and policy adjustments based on changing circumstances optimize insurance benefits and ensure seamless risk mitigation.

- Continual Evaluation and Adjustment: Insurance needs evolve over time in response to changing circumstances, market trends, and regulatory requirements. Continual evaluation of insurance strategies, periodic reassessment of coverage adequacy, and proactive adjustments to insurance portfolios are critical for staying ahead of emerging risks and maintaining robust risk mitigation measures.

Leveraging Insurance for Financial Security

Insurance is a cornerstone of financial security, providing individuals and businesses with peace of mind, protection against losses, and a safety net in times of crisis. By strategically utilizing insurance strategies for risk mitigation and transfer, individuals and organizations can fortify their financial resilience and secure a stable future.

Empowering Financial Stability Through Insurance

As renowned investor and philanthropist Warren Buffett once said, “Risk comes from not knowing what you’re doing.” By equipping oneself with a sound understanding of insurance strategies and implementing proactive risk mitigation measures, individuals and businesses can navigate uncertainties with confidence and protect their financial well-being.

In conclusion, insurance strategies play a vital role in risk management and financial planning, offering a shield against potential threats and uncertainties. By embracing a comprehensive approach to insurance, individuals and organizations can fortify their financial security, mitigate risks effectively, and pave the way for a resilient future.

Promoting Samunnati Ventures: At Samunnati Ventures, we specialize in guiding individuals and businesses in developing tailored insurance strategies for risk mitigation and financial security. Contact us today to explore how our expertise can help you protect your assets, mitigate risks, and secure a stable financial future.