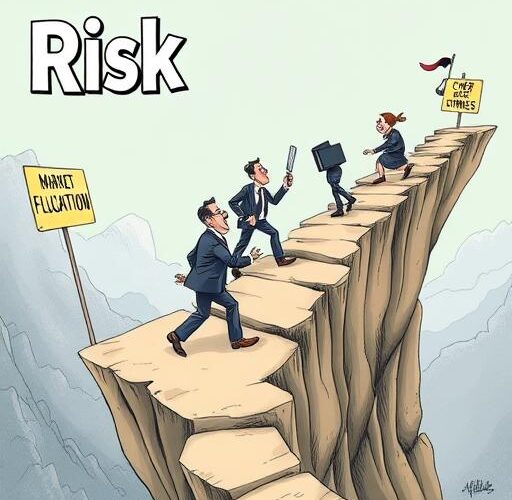

Every business, regardless of its size or sector, encounters uncertainty. From supply chain disruptions to rapidly evolving regulations or digital threats, managers and business owners face a constant stream of risks that can undermine growth, reputation, or even daily operations. Without a structured approach to managing these hazards, opportunities may be lost and minor problems can quickly escalate. This guide walks you through a robust, step-by-step process for effective risk management, empowering you to proactively safeguard your business and enhance resilience in an unpredictable world.

The “What”: Defining Risk Management

Risk management is the systematic process by which organisations identify, assess, and address the myriad of uncertainties that could hinder the achievement of strategic objectives. At its core, it is more than just avoiding negative outcomes—it is about understanding the spectrum of potential threats and opportunities, prioritising them, and taking action to protect and create value.

This discipline involves several critical phases: identification of risks, thorough assessment and ranking of these risks by likelihood and potential impact, selection and implementation of appropriate mitigation strategies, and continuous monitoring and review. Risks may be internal—such as operational inefficiencies, employee conduct, or technology failures—or external, including economic shifts, natural disasters, or regulatory changes.

Importantly, risk management does not aim to eliminate risk entirely—an impossible target—but to minimise adverse impacts to levels that are acceptable and manageable for the organisation. The result is greater confidence in decision-making and a more resilient business strategy.

The “Why”: The Importance of Risk Management

For managers and business owners, the importance of risk management has seldom been more pronounced than in today’s climate of constant change. The aftermath of global events, such as the COVID-19 pandemic, exposed just how vulnerable even established businesses can be to unforeseen threats, from supply chain snags to regulatory upheaval and cyber-attacks.

Effective risk management enables businesses to anticipate issues before they grow, respond swiftly to crises, and even turn risks into opportunities for innovation or competitive advantage. For example, when digital transformation exposed organisations to new cybersecurity risks, those who invested early in robust digital risk management found themselves more adaptable and better positioned for remote work environments.

Ultimately, a sound risk management process:

- Protects assets, finances, and reputation

- Ensures business continuity and operational stability

- Facilitates compliance with legal and regulatory requirements

- Enhances stakeholder confidence and trust

- Supports strategic planning and sustainable growth

Neglecting risk management can lead to costly disruptions, lost opportunities, and, in severe cases, existential threats to the business.

The “How”: Step-by-Step Risk Management Process

- Establish the Context

Define the scope and objectives of your risk management efforts. Understand your organisation’s environment, risk appetite, and specific threats or opportunities relevant to your market. - Identify Risks

Systematically pinpoint all potential risks, both internal and external, using techniques such as brainstorming, checklists, SWOT analysis, or reviewing past incidents. Involve employees from various levels for a broad perspective. - Assess and Prioritise

Evaluate each risk’s likelihood and potential impact. Use a simple scoring system (e.g., low, medium, high) or a formal risk matrix. Focus first on risks that could cause the greatest harm or disruption. - Develop Mitigation Strategies

For each significant risk, decide on appropriate measures to avoid, reduce, transfer (e.g., through insurance), or accept the risk. Assign responsible individuals for implementation. - Implement Controls

Put the selected strategies into action. Develop policies, procedures, and monitoring tools. Ensure staff are aware of their roles in risk management. - Monitor and Review

Risk management is an ongoing process. Continually track risks, test controls, and update your risk register as circumstances change. Conduct regular reviews and simulations to ensure readiness. - Communicate and Report

Keep stakeholders, including employees, senior leaders, and external partners, informed about key risks and mitigation efforts. Transparent reporting fosters accountability and early warning of emerging threats.

Conclusion

In an era defined by uncertainty, a structured approach to risk management offers more than just protection—it builds a foundation for responsible growth. By understanding, prioritising, and systematically addressing risks, managers and business owners can ensure their organisations are prepared to weather disruptions and seize new opportunities. Regularly revisiting and refining your risk management process ensures your business remains resilient, agile, and ready for whatever lies ahead.

Key Takeaways

- Risk management is an essential, ongoing process for all organisations.

- Effective risk management enhances stability, reputation, and stakeholder trust.

- A systematic approach involves risk identification, assessment, mitigation, and ongoing review.

- Engagement of leadership and staff at all levels improves risk awareness and response.

- Proactive risk management can transform challenges into strategic opportunities.